When Love Isn't Enough: The Real Test of Product-Market Fit

Spot true product market fit (PMF), avoid the trap of user enthusiasm, and use cohort value trajectories to ensure sustainable, scalable growth before it's too late.

Retention and praise may look like Product-Market Fit. Customers can swear they cannot live without your product. Yet without solid unit economics, it is nothing but a mirage. Product love without profit is hype dressed as validation.

MoviePass offered unlimited movies for $9.95 a month. Growth exploded and hype spread quickly, yet every ticket sold deepened its losses until collapse. What MoviePass did with tickets, AI SaaS companies now risk doing with compute. Cursor, the fastest growing example, is adored by users. But if adoption depends on subsidized compute, that is not PMF. It is demand manufactured by price distortion.

“At the right subsidy, everything looks like PMF.”

Subsidized prices can make any product look like PMF. Lower the price enough and demand always rises. But this demand is artificial, a reflection of discounts rather than true market validation. In AI this illusion spreads quickly because compute costs are high and subsidies are tempting.

Marc Andreessen described PMF as satisfying strong market demand. Many founders interpret that as the magical moment when usage soars, word-of-mouth compounds, and customers swear they cannot live without the product. It feels like proof of success.

Yet love can mislead. A product may be adored and habit-forming, yet still push its maker toward collapse. Retention is not revenue. Buzz is not profit. With prices low enough, anything can look like PMF. The real test is not enthusiasm but economics.

What Product-Market Fit Isn't

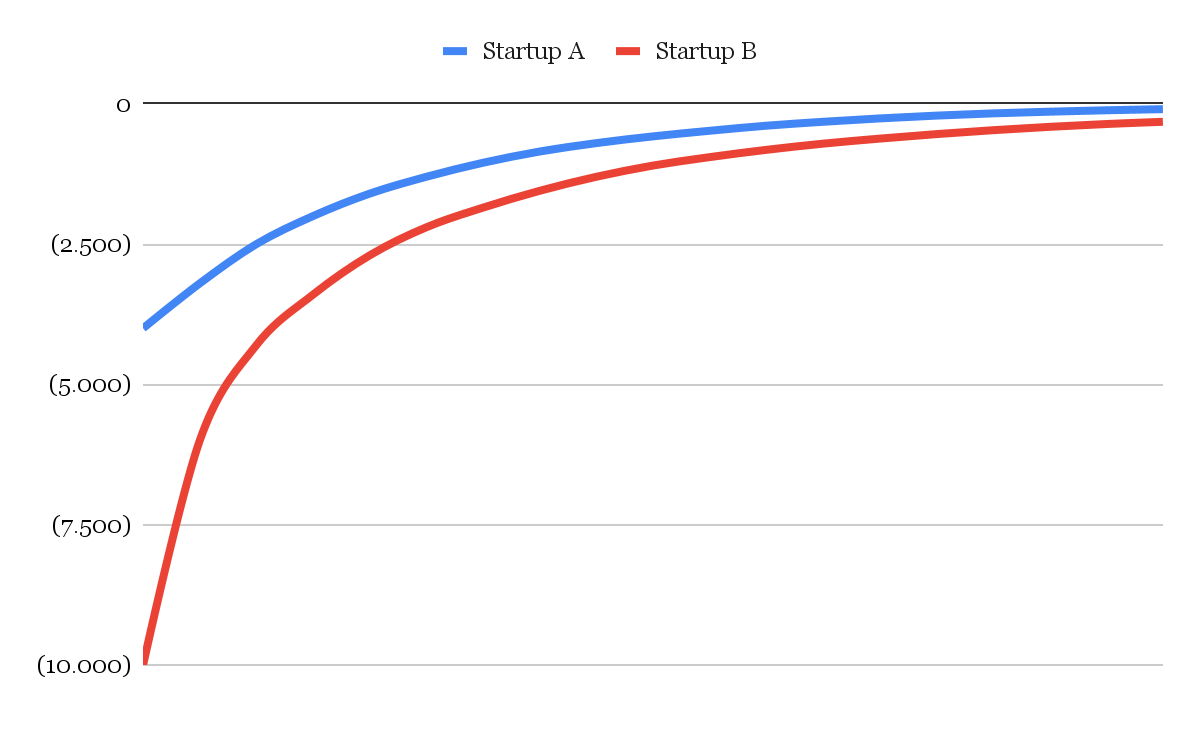

To grasp PMF, first recognize what it isn't. A business thrives only when customers generate more value than their acquisition cost. If this balance stays negative, no popularity ensures survival. Cohort value trajectories, charts tracking cumulative variable profit per customer group over time, reveal this truth.

For each customer, subtract initial acquisition cost and ongoing variable costs (like hosting, API calls, or transaction fees) from their revenue. These curves start below zero due to acquisition costs and focus on unit economics by excluding fixed costs, showing if the product creates per user profit. True PMF emerges when these curves consistently climb above zero, proving users not only love the product but repay costs and add scalable value.

This method gives founders a simple tool for assessing unit economics, more practical than complex LTV models early on. Figure 1 illustrates this: two startups with strong engagement fail to recover acquisition costs, their value curves stuck below zero, proving usage alone doesn't deliver lasting value.

The Product-Market Fit Trap

The riskiest moments for a startup often look like triumphs. Growth is rapid, users are engaged, and buzz is everywhere. Yet beneath the surface the model is broken. This is the PMF trap.

Some propose a new term, Business-Market Fit, as if PMF itself ignored economics. That misses the point. If economics, channels, or the model don’t work, then there is no PMF to begin with.

Splitting them apart only creates the illusion of progress where no fit actually exists. With subsidies or prices set low enough, any product can appear to fit the market. In AI this illusion spreads even faster, since adoption often reflects discounted compute, not sustainable demand. New acronyms only confuse. The solution is not BMF. The solution is to keep economics at the core of PMF.

More precisely: Product-Market Fit is achieved when your recent cohorts are already profitable or show a clear path toward variable profitability.

MoviePass fell into this trap. Strong metrics, high retention, frequent use, and loyal fans hid flaws. Each cohort increased losses, with costs outpacing revenue. Cohort analysis would have shown negative value curves with no profitability path. It looked like PMF but lacked sustainability. Rising engagement with negative margins amplifies losses, not success. True fit requires usage that strengthens the business, shown by cohort trajectories.

What Product-Market Fit Looks Like

If user enthusiasm misleads, what signals real progress? Shift from feelings to measurable outcomes. Track value creation, cohort by cohort, as users interact and either contribute profit or fall short.

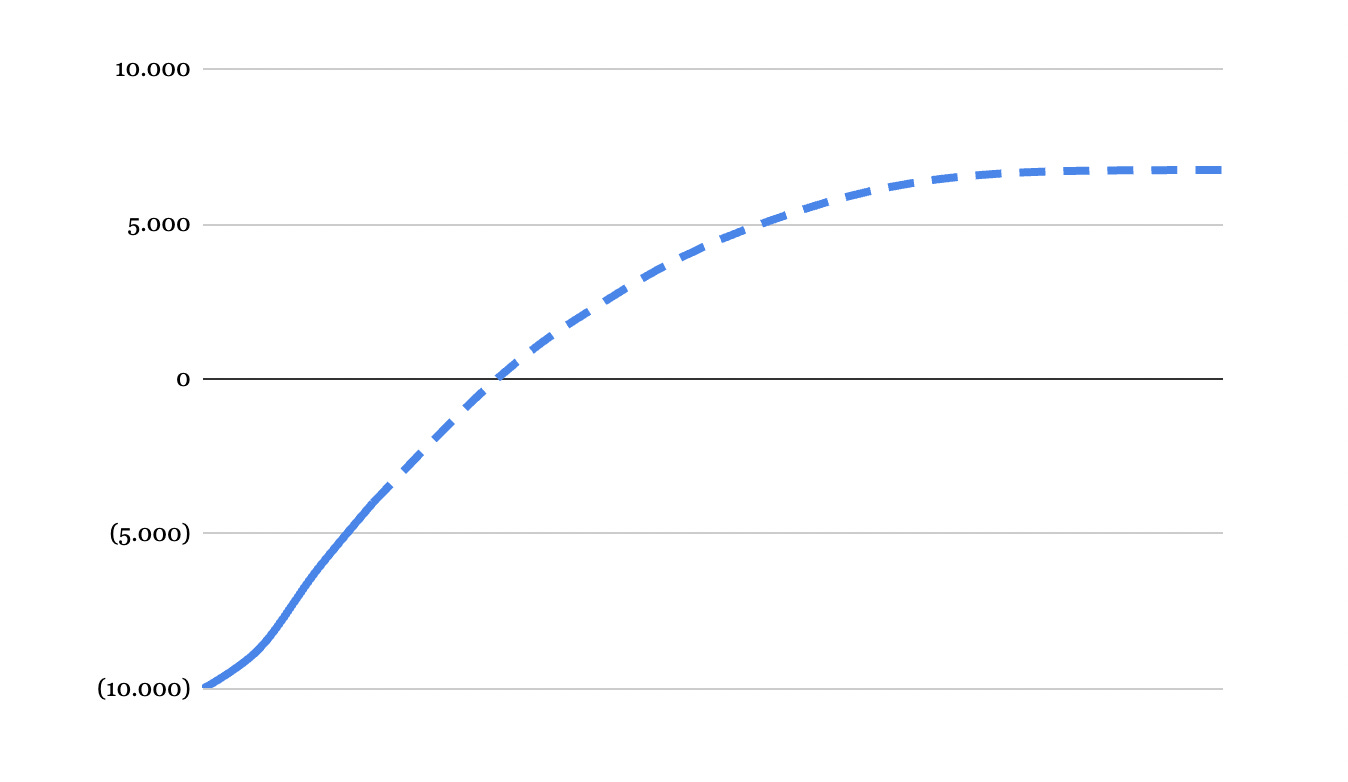

Cohort value trajectories, charts tracking revenue versus costs for user groups over time, reveal this. Starting negative due to acquisition costs, these curves climb with margin generating products. A steady upward trend, even if gradual, signals progress. PMF doesn't require instant ROI. High acquisition costs may delay breakeven, but the key isn't speed to zero; it's a strong, upward trajectory. A steep slope shows value, even with delayed returns, while early flattening flags risks and scaling issues.

Breakeven can wait; the trajectory matters most. A consistent climb enables forecasting, revealing PMF early. Figure 2 shows a cohort curve breaking even and entering positive territory, with a dotted line projecting future profits based on its slope. Steady positive movement ensures even long paybacks create lasting value.

Product-Market Fit Is a Trajectory, Not a Milestone

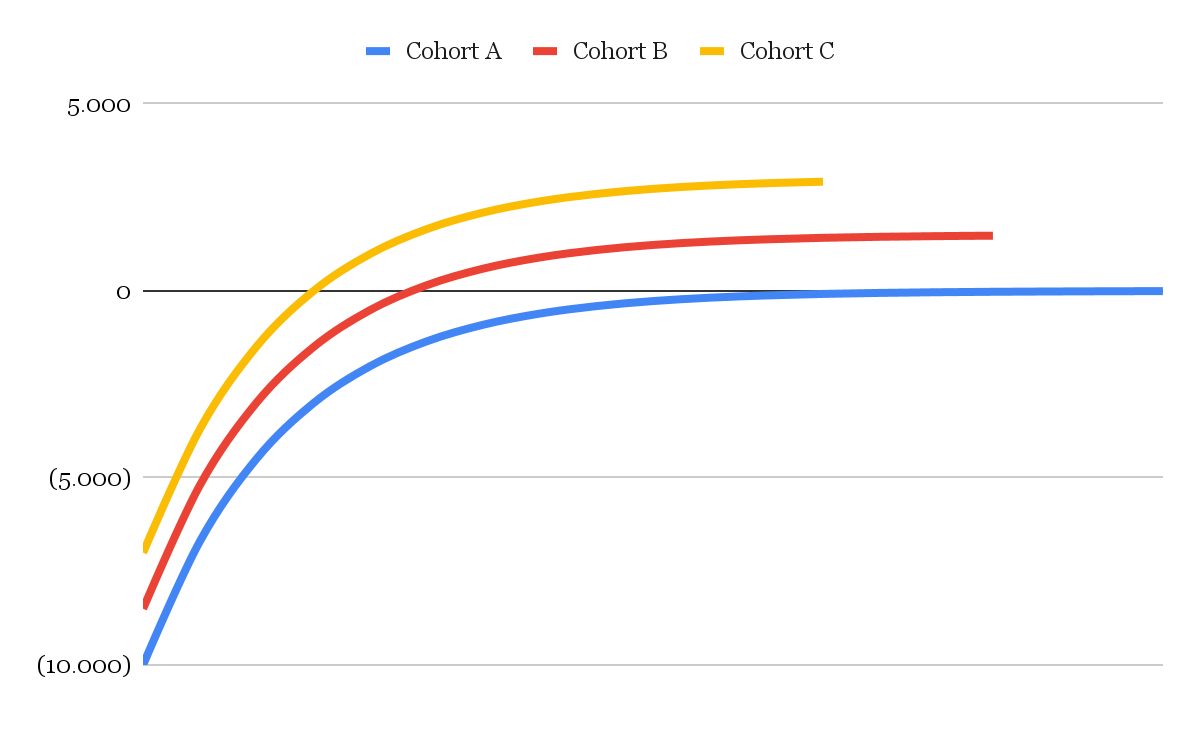

PMF isn't a single moment; it's a trajectory. It develops as the product improves, better matched customers join, and both the economics and the way customers are acquired and monetized start to reinforce each other. Channels and the model aren’t separate from PMF — they are part of what makes the trajectory real. Early cohorts may not break even, which is normal. The key is direction: are newer cohorts performing better?

Figure 3 shows this progression. All cohorts start at the same acquisition cost, but newer ones climb faster, reach profit sooner, and peak higher. This reflects a learning business: refining the product, optimizing acquisition, and attracting better users. When each cohort surpasses the last, the company isn't just growing; it's building compounding strength. That's when PMF becomes clear.

Cohort trajectories reveal if newer groups generate more value, repay costs faster, or cost less to serve. When curves rise consistently or improve, the business compounds value efficiently. Stalled or flat curves signal fragility. These charts cut through gut feelings, showing whether the business builds strength or risk.

The True Measure of Product-Market Fit

Growth measured through cohort value trajectories changes the lens. The real questions are: Are we attracting the right users? Do newer cohorts outperform earlier ones? Can growth scale without breaking the economics?

Startups rarely fail because no one cares about the product; they fail because enthusiasm doesn’t pay the bills. In AI, the danger is sharper: compute costs escalate quickly, and subsidies can disguise fragility.

Product-Market Fit is not delight, surveys, or hype. It is a financial test: clients who pay back their CAC, generate contribution margin, and improve over time. Love may open the door, but economics decide whether the business survives. In the end, the true test of PMF is not whether clients say they care—it is whether the numbers prove they do.